michigan gas tax revenue

Virtually all of the taxes levied upon gasoline by the State of Michigan are earmarked for special purposes. Federal excise tax rates on various motor fuel products are as follows.

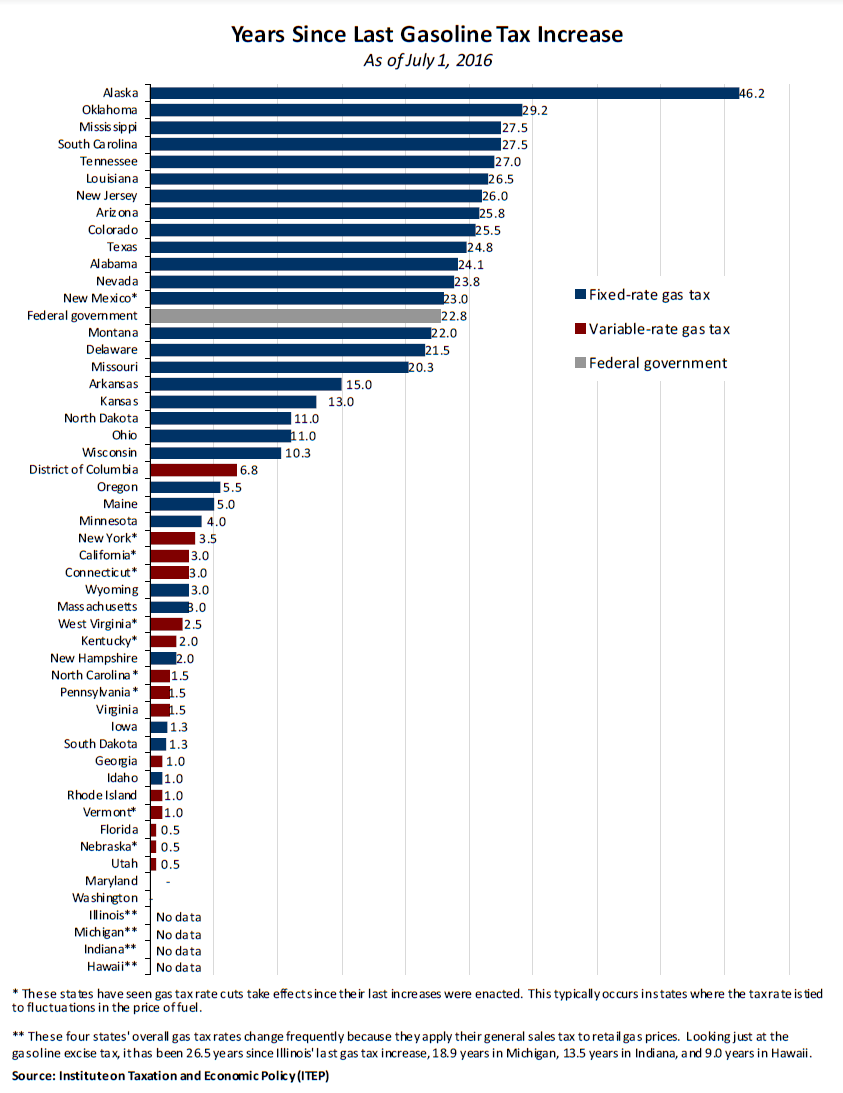

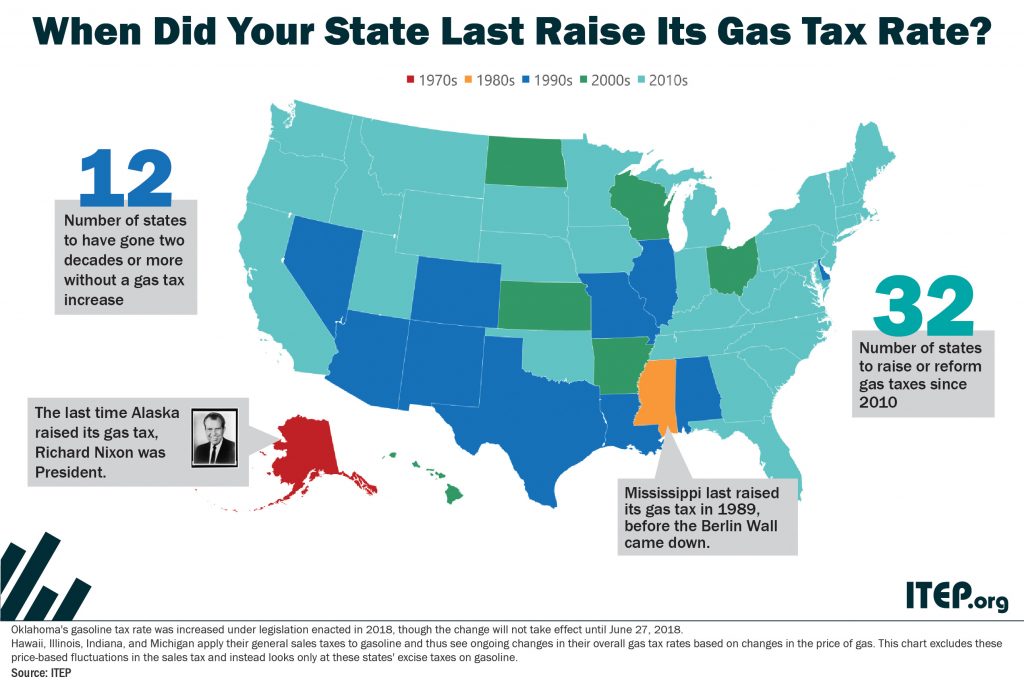

How Long Has It Been Since Your State Raised Its Gas Tax Itep

During fiscal year 2021 the state collected 358 billion in taxes.

. The Michigan Gas Tax Amendment Proposal M was on the 1978 ballot in Michigan as a legislatively referred constitutional amendmentIt was approvedProposal M allocated at least. In 2020 Michigan collected 317 billion in. The Michigan Severance Tax Act MCL 205301 levies a tax on oil and gas severed from the soil in Michigan.

The owner of the motor fuel is required to fill out form number 4010 and remit any additional motor fuel tax that may be owed to the Department. Revenue from Michigans General Fund and School Aid Fund earmarked taxes totaled 28 billion. If you have any questions in regards to this.

In Michigan the revenue from regular gasoline sales tax was projected to be 621 million in the 2022 fiscal year. Currently state gas taxes range from 1432 cents per gallon in Alaska to 6205 cents per gallon in California not including the 184 cents per gallon federal gas tax they. 0183 per gallon.

Producers or purchasers are required to report the oil and gas production and the. Michigan Fuel Product Codes - Effective October 2017. If the share of EVs were to increase to half of all vehicles we estimate in our report that the Michigan gas tax shortfall would grow to 2 billion per year by 2050.

Office of Financial Management. Streamlined Sales and Use Tax Project. Michigan Terminal Control Numbers.

Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. 003 gallon. 0272 gallon.

For transactions occurring on and after October 1 2015 an out-of-state seller may be. 2015 PA 179 earmarked. How much tax does the state collect.

Tax revenue in FY 2010-11. History of Michigan Gas and Diesel Fuel Tax Rates Sources. Its important to future-proof Michigans.

Federal Excise Tax In addition to Michigans 19-cent. Avalara can simplify fuel energy and motor tax rate calculation in multiple states. But that was based on an expected average price per gallon at.

Oil Gas Severance Tax 35 363 344 990 350 675 Other Taxes8 238 279 2706 32. Notice of New Sales Tax Requirements for Out-of-State Sellers. Bureau of Labor Statistics US.

The 19-cent-per-gallon gasoline excise tax is restricted for deposit in the Michigan. 0272 gallon. The study estimates that fuel efficiency gains alone would lead to a 1 billion per year shortfall in Michigan gas tax revenue by 2050.

Revenue from the motor fuel taxes is dedicated by the 1963 Michigan Constitution for transportation. The revenue Michigan received from its motor fuel tax MFT in fiscal year 2018 was 226 billion of which 259 percent or 5879 million was diverted to the. Weve included gasoline diesel aviation fuel and jet fuel tax rates for 2022.

003 gallon. Fiscal Year Ending 1987 1989 1991 1993. Service Interruption and Import Verification Numbers.

It is estimated that fuel efficiency gains alone would lead to a 1 billion per year shortfall in Michigan gas tax revenue by 2050. See current gas tax by state.

Calls To Suspend Gas Taxes Across U S Grow As Prices Surge Abc News

Governor Gretchen Whitmer Vetoes Suspension Of Michigan S Gas Tax Wwmt

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Michigan House Dem Leader Says Whitmer S 45 Cent Gas Tax Is Probably Dead Bridge Michigan

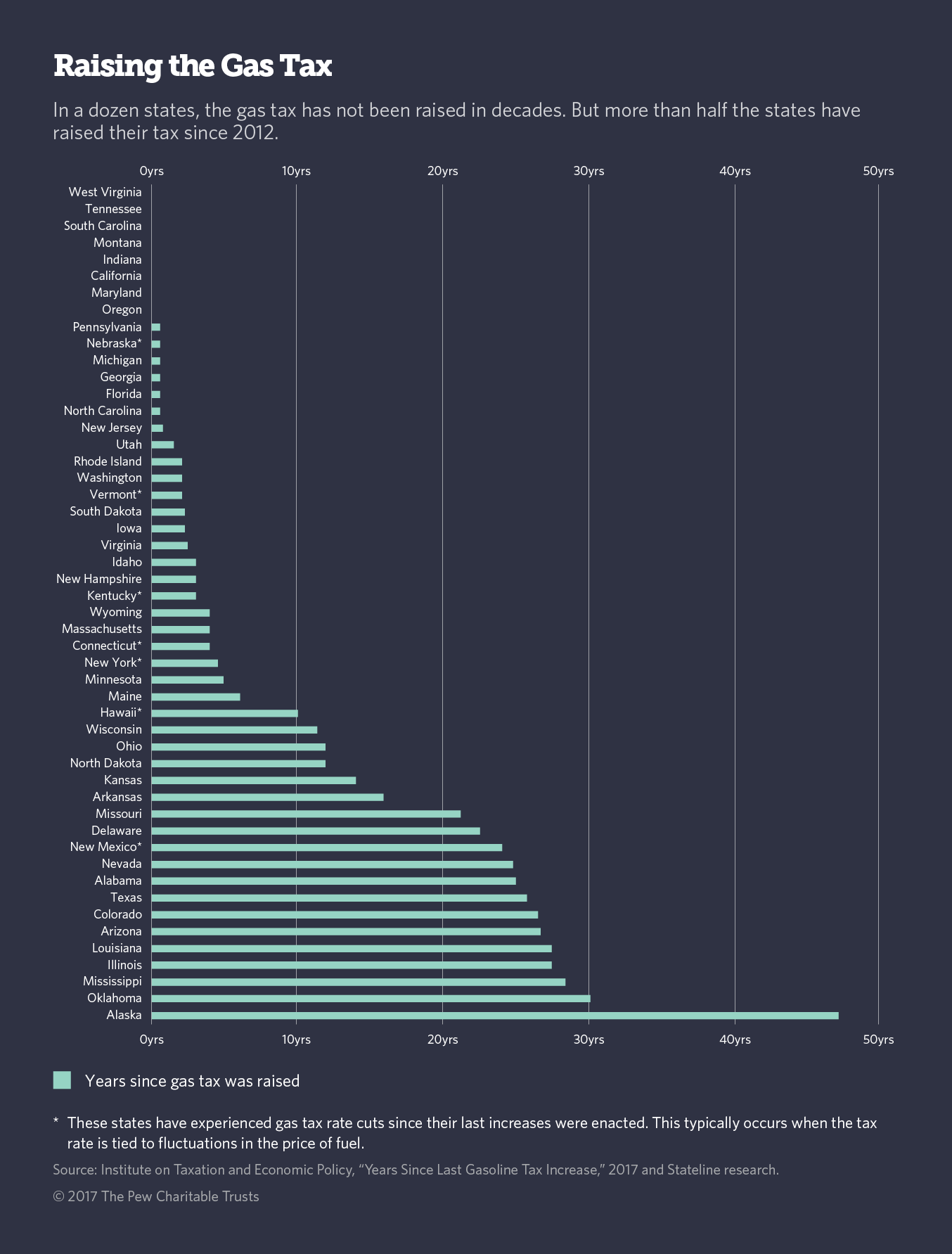

Reluctant States Raise Gas Taxes To Repair Roads The Pew Charitable Trusts

Michigan Gas Prices Would Drop 50 Cents Under Senate Approved Summer Tax Cut Mlive Com

Michigan Weed Sales Top 1 Billion In 2021 The Oakland Press

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

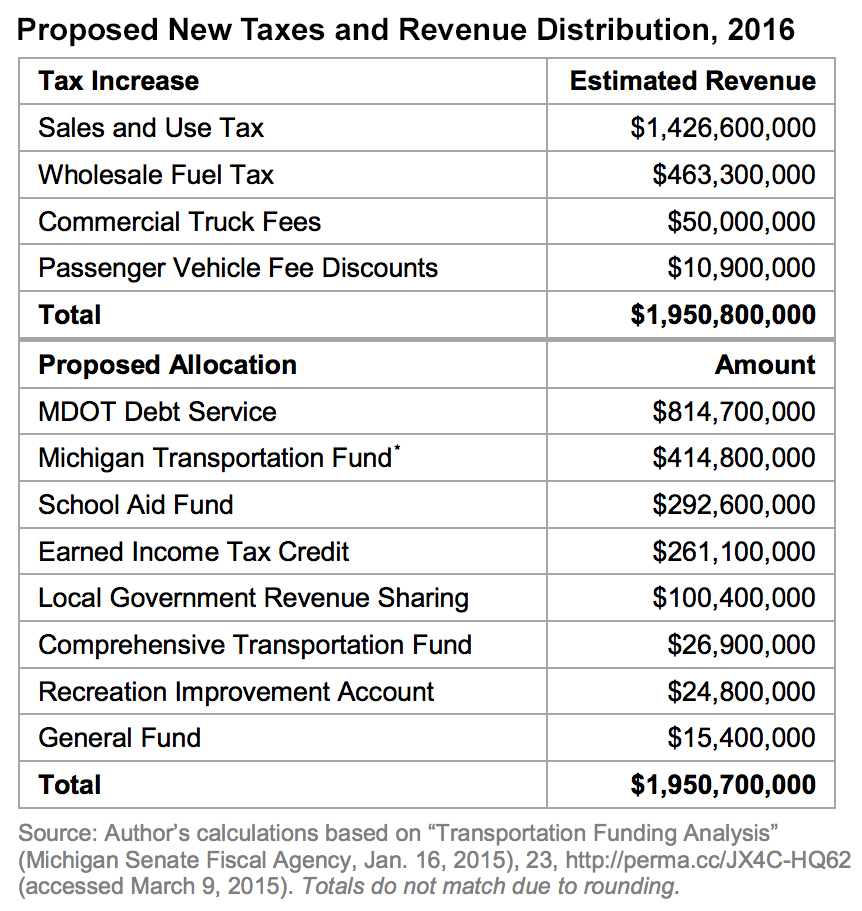

Michigan S May Tax Proposal Mackinac Center

Michigan Governor Gretchen Whitmer Proposes Gas Tax Increase

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

What Does An Additional Penny Of Gas Tax Buy Bridge Michigan

Mlive Com Governor Whitmer And Most Democratic Lawmakers Said The Loss In Revenue Generated By Suspending The State S Gas Tax As Proposed By Republicans Would Be Problematic For Ongoing Construction Projects

Covid 19 Pandemic Takes A Bite Out Of State Motor Fuel Taxes Citizens Research Council Of Michigan

Most States Have Raised Gas Taxes In Recent Years Itep

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

Chart 12 U S States Are Boosting Their Gasoline Tax Today Statista